Global risk assets have rallied in the last two weeks, encouraged by signs of policy changes in China and the US Federal Reserve, and also by buoyancy in retail sales growth in the US. While this has reduced the markets’ assessment of global recession risk, compared to the dark days in early February, the Fulcrum “nowcast” models have actually moved slightly in the opposite direction. Full details of the monthly nowcasts are available here.

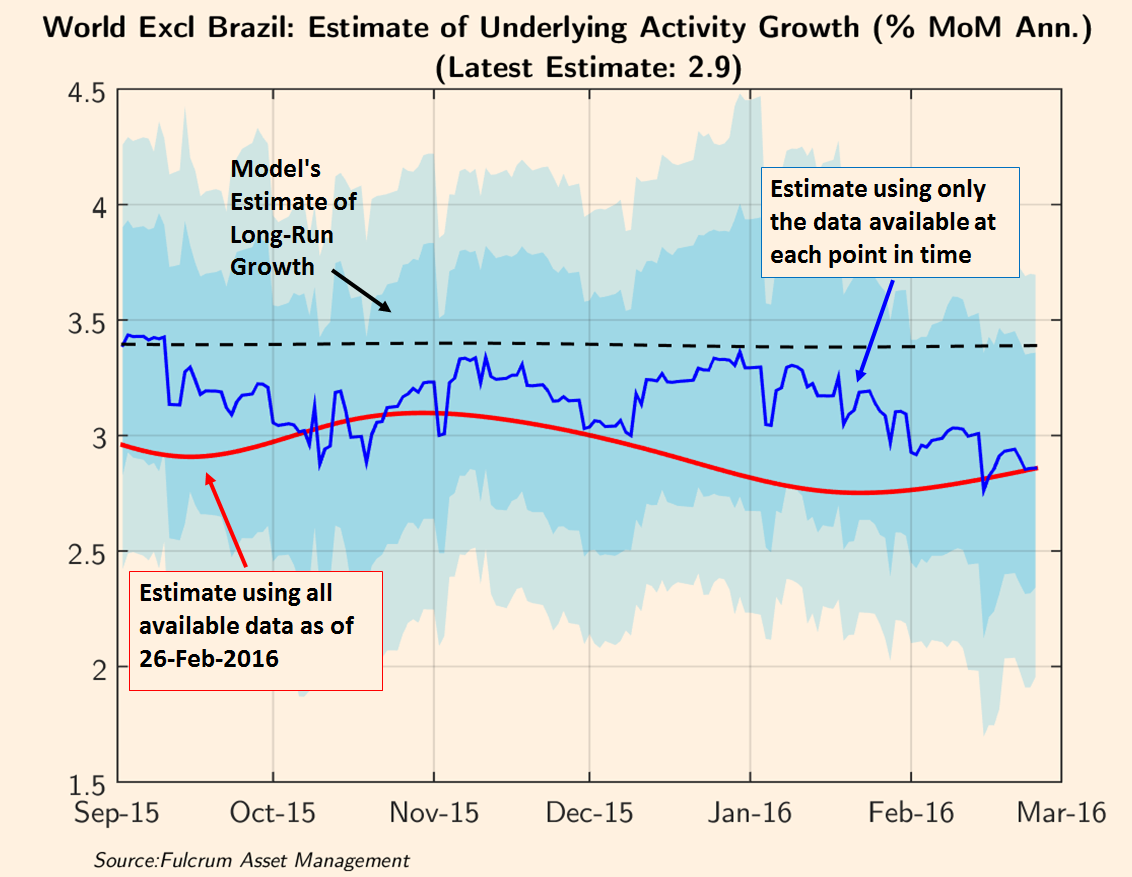

The world economy is still very far from a recession, but the nowcasts show clearer signs of a slowdown in global activity growth. This probably started in early 2015, but the downward momentum has gathered pace since the beginning of 2016. The model’s estimates of global GDP growth (blue line) have declined from 3.4 per cent in late 2015 to 2.9 per cent now, a development which warrants careful monitoring.

The world economy is still very far from a recession, but the nowcasts show clearer signs of a slowdown in global activity growth. This probably started in early 2015, but the downward momentum has gathered pace since the beginning of 2016. The model’s estimates of global GDP growth (blue line) have declined from 3.4 per cent in late 2015 to 2.9 per cent now, a development which warrants careful monitoring.

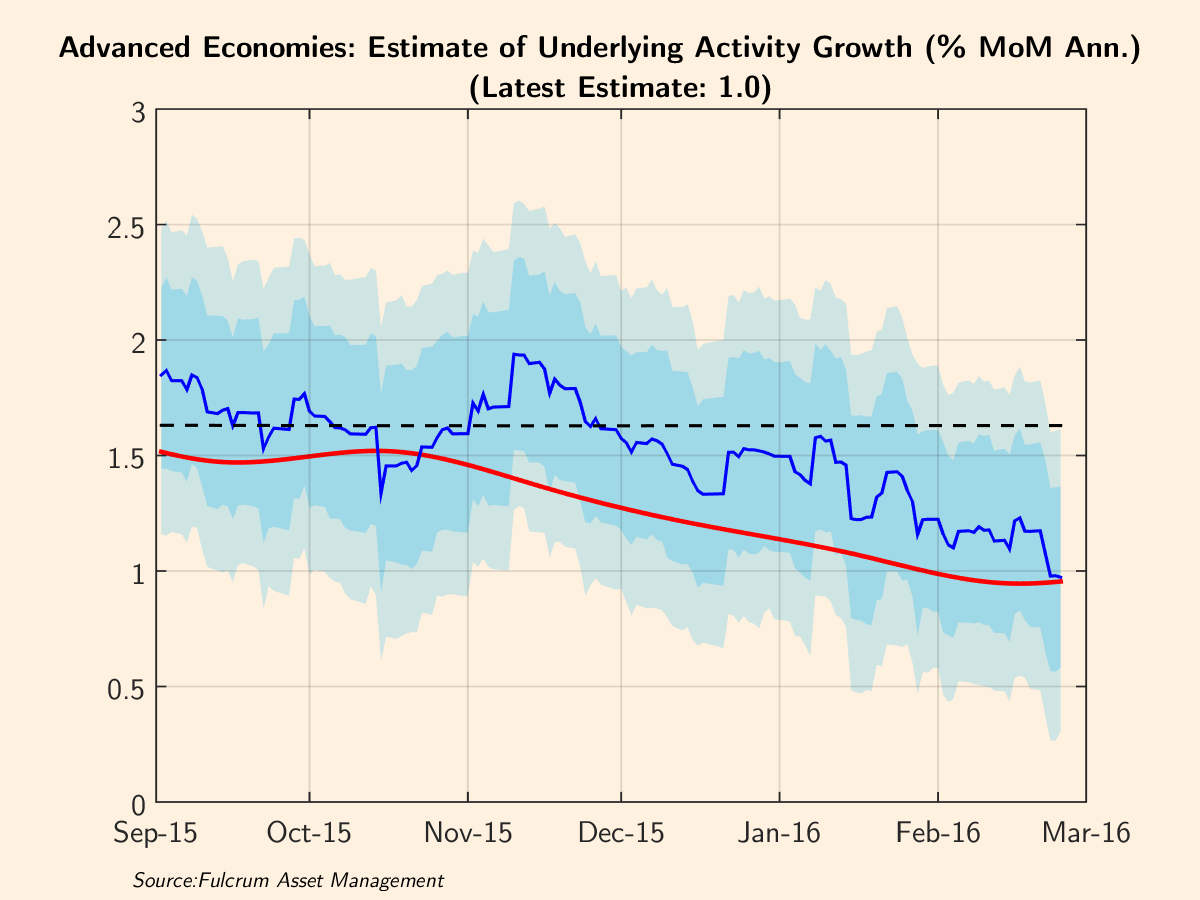

It is clear that the advanced economies have slowed significantly since last November.

The estimated US growth rate has remained sluggish at around 1 per cent, so growth in the advanced economies has continued to decline, and is now running at only 1.0 per cent, which is markedly below trend and still dropping. It is true that some alternative estimates for US growth (including the Atlanta Fed nowcast) suggest that the growth rate may have rebounded from 1 per cent in 2015 Q4 to about 2 per cent in the current calendar quarter. But the Fulcrum models have done a good job in identifying the continuous US slowdown in the past 12 months, so their bleak message should not be discounted.

The estimated US growth rate has remained sluggish at around 1 per cent, so growth in the advanced economies has continued to decline, and is now running at only 1.0 per cent, which is markedly below trend and still dropping. It is true that some alternative estimates for US growth (including the Atlanta Fed nowcast) suggest that the growth rate may have rebounded from 1 per cent in 2015 Q4 to about 2 per cent in the current calendar quarter. But the Fulcrum models have done a good job in identifying the continuous US slowdown in the past 12 months, so their bleak message should not be discounted.

The key change this month is a further decline in the growth rate in the eurozone. This is a distinct change in the pattern identified by the models in late 2015, when the eurozone was the strongest of the major advanced blocs. This situation has changed sharply in the past two months, with the German economy becoming markedly weaker.

Read more